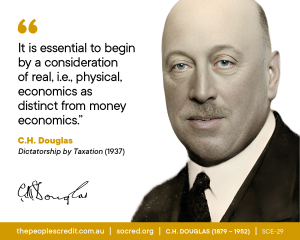

The financial and economic problem that has plagued civilization since the dawn of the industrial age may be described as a Gordian knot[1], i.e., as an intractable problem that cannot be solved within its own conventional framework, but only by thinking outside of the box. Those few of us who have studied both the problem and Douglas’ response to it in-depth have become convinced that Douglas, like a modern-day Alexander, cut this Gordian knot and discovered the correct path for the harmonious resolution of this problem.

The irony, however, is that when it comes to effectively and efficiently communicating Douglas’ brilliance to a wider public, the Douglas Social Credit vision for our financial system and economic life may itself be likened to a Gordian knot (not in itself, but in deciding how best to explain it). There are so many issues, positions, evidences, and arguments bound up in the problem and so many potential misapprehensions, prejudices, ideological blinders, and confusions on the part of the newcomer, that it normally takes an individual, even those who are well-disposed, countless hours of intense study to decipher exactly what Douglas was on about and to fully appreciate the ingeniousness and elegance of his proposed solutions to our various (but often intimately and intricately related) social problems. Over the years, I have attempted, by various means and with various degrees of success, to drastically cut down the time and effort necessary for the would-be learner to understand DSC. After the lengthy pondering that was occasioned by last month’s attempt (“Douglas Social Credit by Way of Metaphor”), I think I have now found, in its broad outlines, what is perhaps the shortest, most direct route that has ever been articulated.